does cash app report to irs reddit

Certain Cash App accounts will receive tax forms for the 2018 tax year. Registration is a piece of cake and you can use your contacts or email addresses to find your friends.

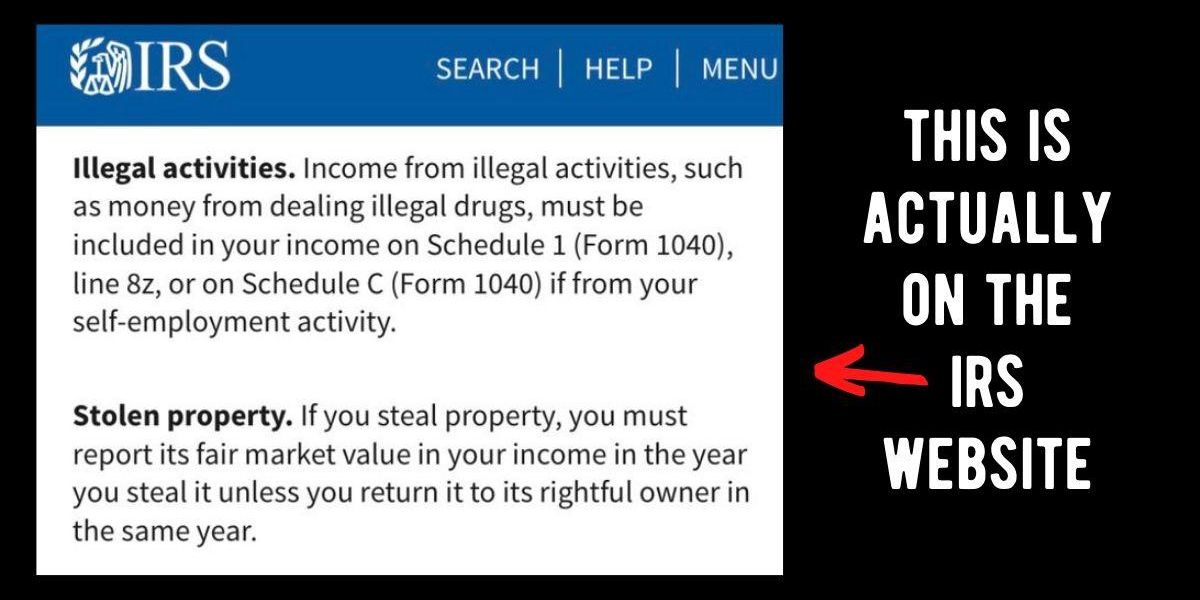

The Irs Says Criminals Have To Report Illegal Income Seriously Upworthy

Zelle does not report any transactions made on the Zelle Network to the IRS even if the total is more than 600.

. Can police track cash App. Certain cash app accounts will receive tax forms for the 2018 tax year. Itll get sent to the irs and might flag their system when you file your taxes and an auditor could ask about it.

You explain and youll be fine. Here are some facts about reporting these payments. Venmo Paypal And Cash App To Report Payments Of 600 Or More To Irs This Year.

Log in to your Cash App Dashboard on web to download your forms. CPA Kemberley Washington explains what you need to know. Does cash APP report to IRS.

Posted by 2 months ago. Tax Reporting for Cash App. PayPal Venmo and Cash App to report commercial transactions over 600 to IRS.

Certain cash app accounts will receive tax forms for the 2018 tax year. Americans for Tax Reform President Grover Norquist discusses the impact of third-party payment processor apps. If payments you receive on the Zelle Network.

IRS Tax Tip 2019-49 April 29 2019 Federal law requires a person to report cash transactions of more than 10000 to the IRS. Form 1099-K Payment Card and Third Party Network Transactions is a variant of Form 1099 used to report payments received through reportable payment card transactions andor settlement of third-party payment network transactions. Venmo PayPal Cash App Must Report Payments of 600 or More to the IRS.

The American Rescue Plan includes a new law that requires cash apps like Venmo and Cash App to report payments of 600 or more to the IRS. Also know does Cashapp report to IRS. For any additional tax information please reach out to a tax professional or visit the IRS website.

Yes Cash App report Personal account and file 1099-B to the IRS for the applicable tax year depending on if you exceed the trigger amount for the 1099 form. Cash App is required by law to file a copy of the Form 1099-BK to the IRS for the applicable tax year. Can Police track Cash App transaction history.

Whos covered For purposes of cash payments a person is defined as an individual company corporation partnership association trust or estate. The biden administration has proposed not approved a plan for banks and other financial institutions including apps like venmo paypal and cash app to report to the irs on money that goes in. And the IRS website says.

1 mobile money apps like Venmo PayPal and Cash App must report annual commercial transactions of 600 or more to the Internal Revenue Service. By lowering the reporting. The law requiring certain payment networks to provide forms 1099K for information reporting does not apply to the Zelle Network.

An answer to this question is both yes and no. Does Cash App Report Personal Accounts To Irs. Does Zelle report how much money I receive to the IRS.

Help Reddit coins Reddit premium. Does cash app report personal accounts to irs reddit.

Venmo Cash App Paypal To Report Transactions Of 600 Or More To Irs Marketplace

Track Mileage Free Using The Free Stride App Tracking Mileage Download Free App App

All You Need To Know If You Use Venmo For Your Business Payments

Venmo Paypal Cash App Must Report Payments Of 600 Or More To The Irs R Technology

Venmo Paypal And Zelle Must Report 600 In Transactions To Irs

Threshold For Cash App Payments Drastically Lowered For Tax Payments Radio Facts

Can Cash App Transactions Be Traced By The Irs And Police How To Track Your Cash App Card

What To Know About The Irs New Reporting Requirements For Venmo Paypal And Other Payment Apps

The Irs Says Criminals Have To Report Illegal Income Seriously Upworthy

Venmo Paypal Cash App Must Report Payments Of 600 Or More To Irs R Technology

Irs Tax Reporting Changes Coming To Payment Apps All About Arizona News

Does Cash App Report Personal Accounts To Irs New 2022 Tax Rules

Does Cash App Report Personal Accounts To Irs New 2022 Tax Rules

Income Reporting How To Avoid Undue Taxes While Using Cash App

Report Your Illegal Income To Irs This Is 100 Real Source Https Www Irs Gov Publications P17 R Cringepics

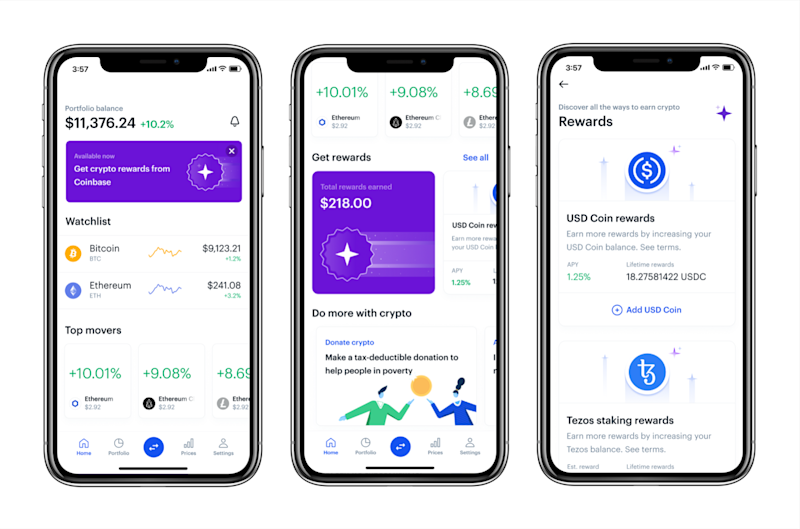

Does Coinbase Report To The Irs Tokentax

Starting January 1 2022 Cash App Business Transactions Of More Than 600 Will Need To Be Reported To The Irs R Cryptocurrency

Does Coinbase Report To The Irs Zenledger

Reporting Income On Stolen Property Can Someone Explain This R Irs